Track charging costs. Save on taxes.

The GoBD-compliant app for EV drivers with company cars. Document every charging session and export directly to DATEV.

The tax office wants receipts. You don't have any.

Without proper documentation, you can't deduct your charging costs. LadeKosten puts an end to the chaos.

The Problem

- Receipt chaos at tax time - documents lost, money gone

- Complicated allowance calculation for home charging

- No overview of business vs. private trips

- Forgot THG quota - premium expired

The Solution

- Automatic cost tracking - Every charge documented and categorized

- One click: DATEV export - Direct import for your tax advisor

- Business vs. Private - Clean separation at a glance

- THG quota tracking - Reminders so you never miss a premium

Never miss a deduction again

Built for freelancers and entrepreneurs who want to maximize their EV cost deductions.

Never search for receipts again

Every charge is automatically recorded and documented. No more paper chaos and Excel spreadsheets.

Tax office ready from day 1

GoBD-compliant, audit-proof recording. You'll be prepared for the next audit.

DATEV Export

One click and your tax advisor has all the data in the right format.

Deduct more, calculate less

34 ct/kWh allowance for home charging automatically calculated. Maximize your refund.

One click – All charges recorded

go-e Charger is automatically detected. Never manually enter charging sessions again.

Secure €50–400 THG premium

Don't forget your annual THG quota. Reminders and status tracking included.

Everything at a glance

Clear design that leaves nothing to be desired

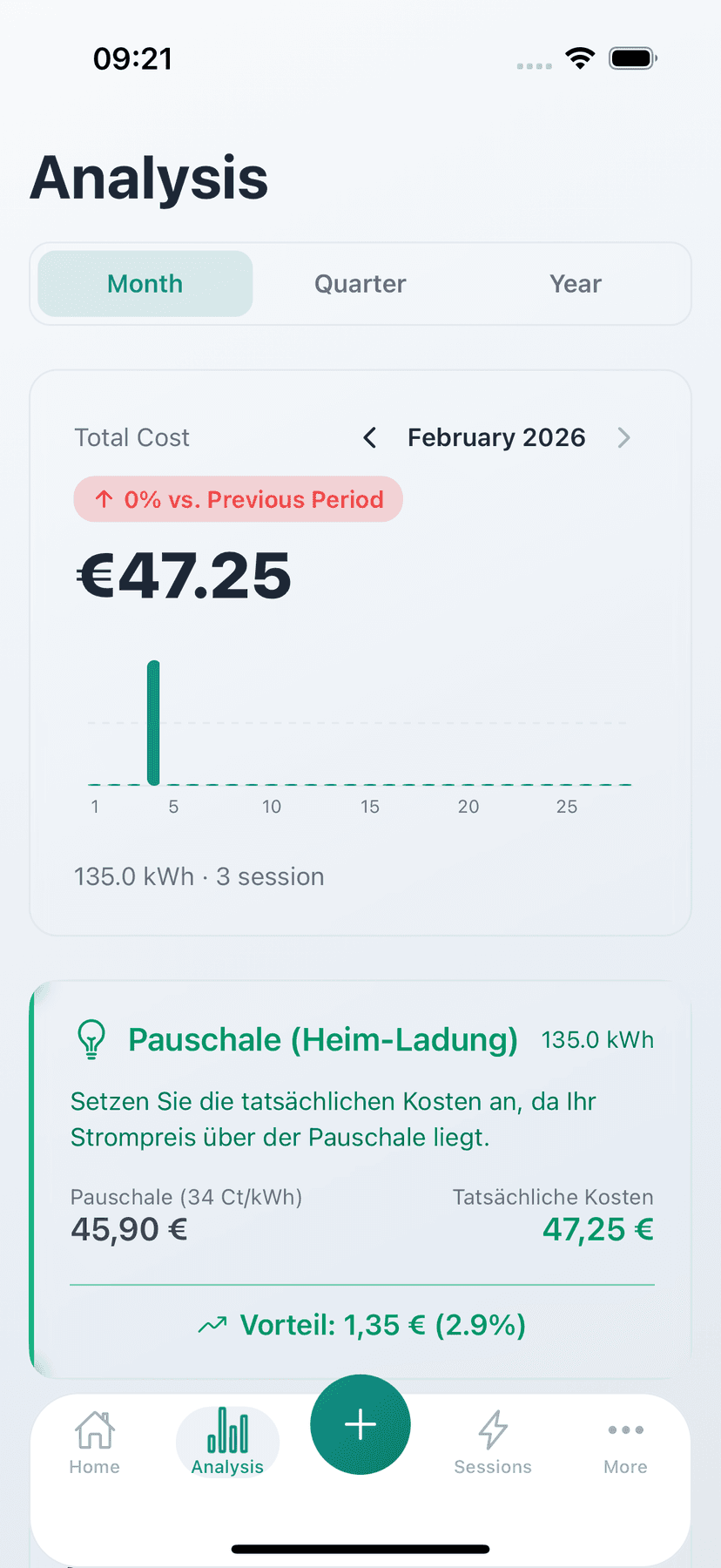

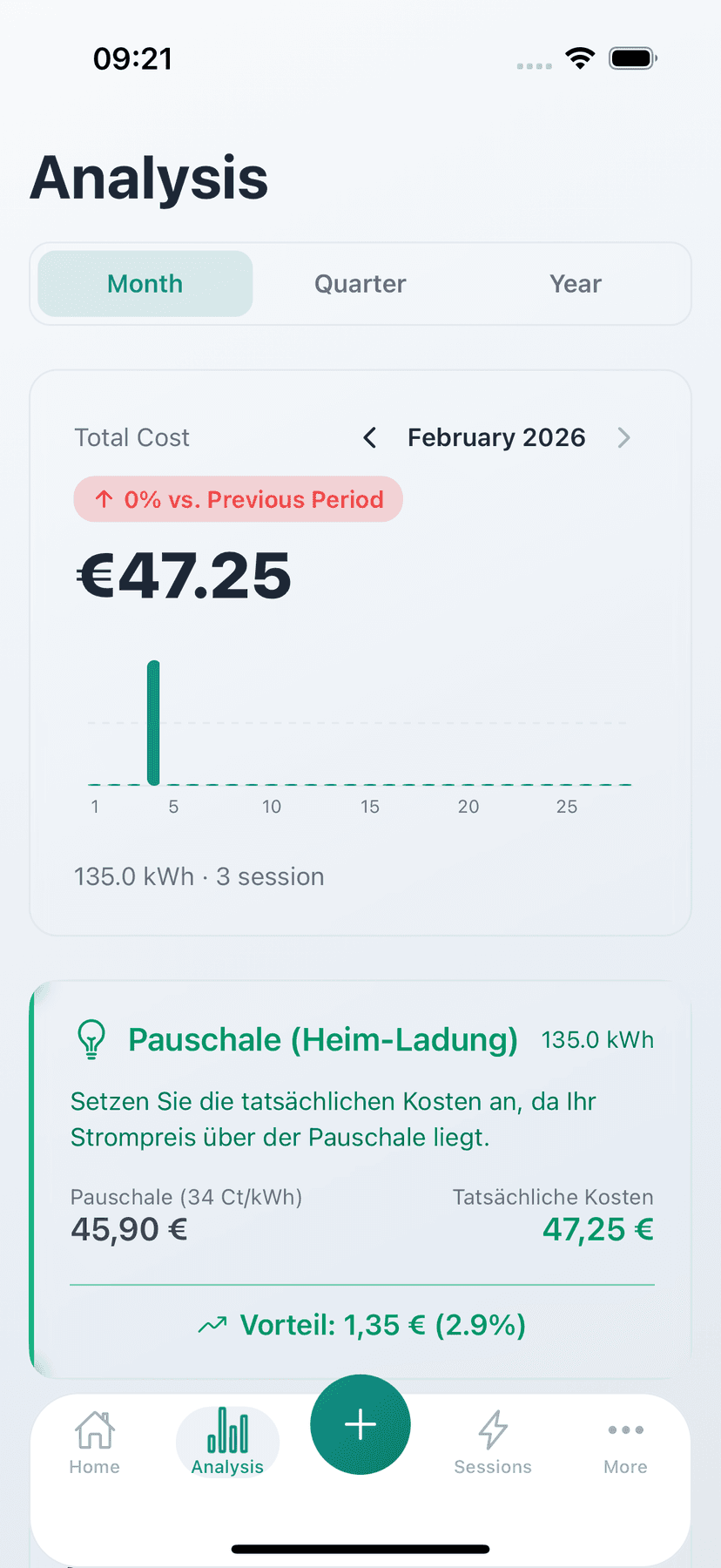

Analytics

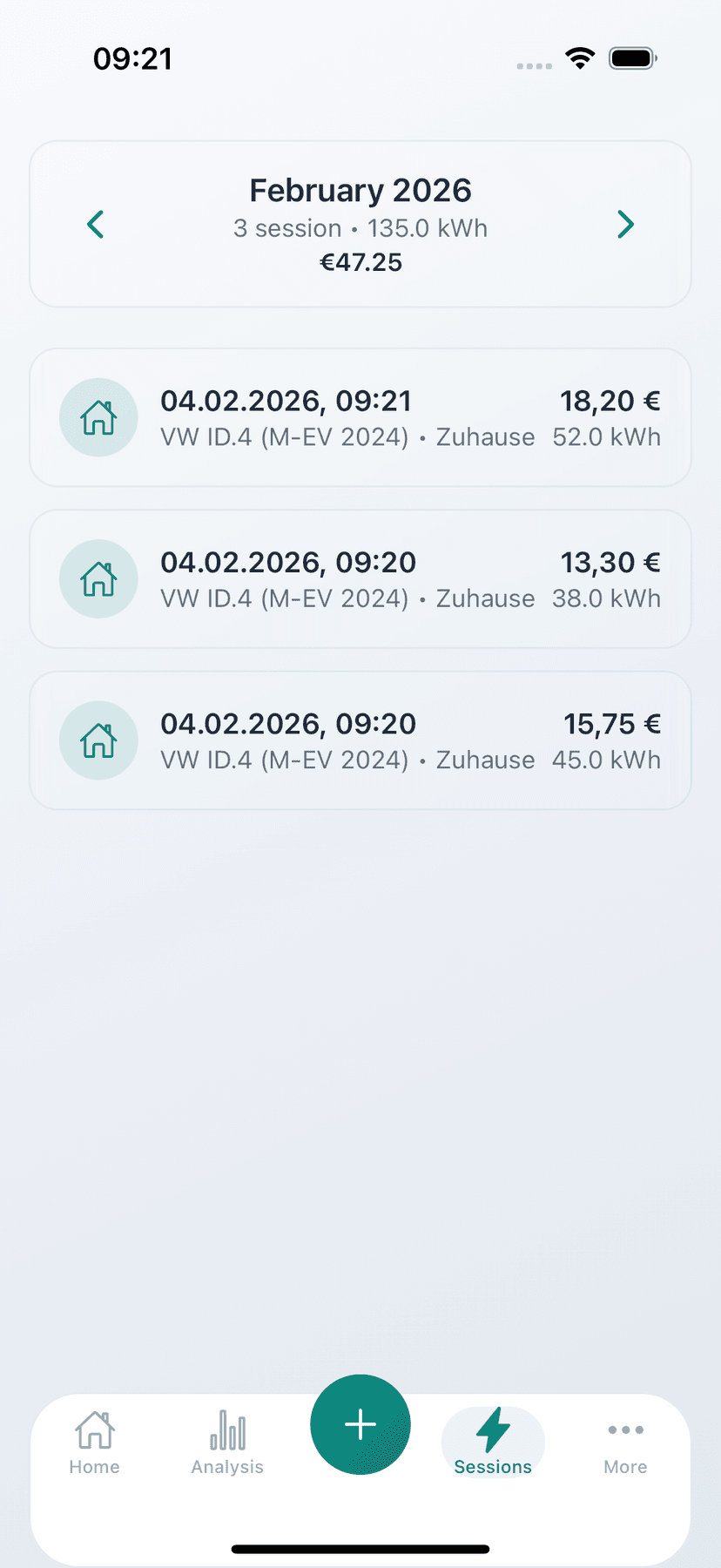

Charging Sessions

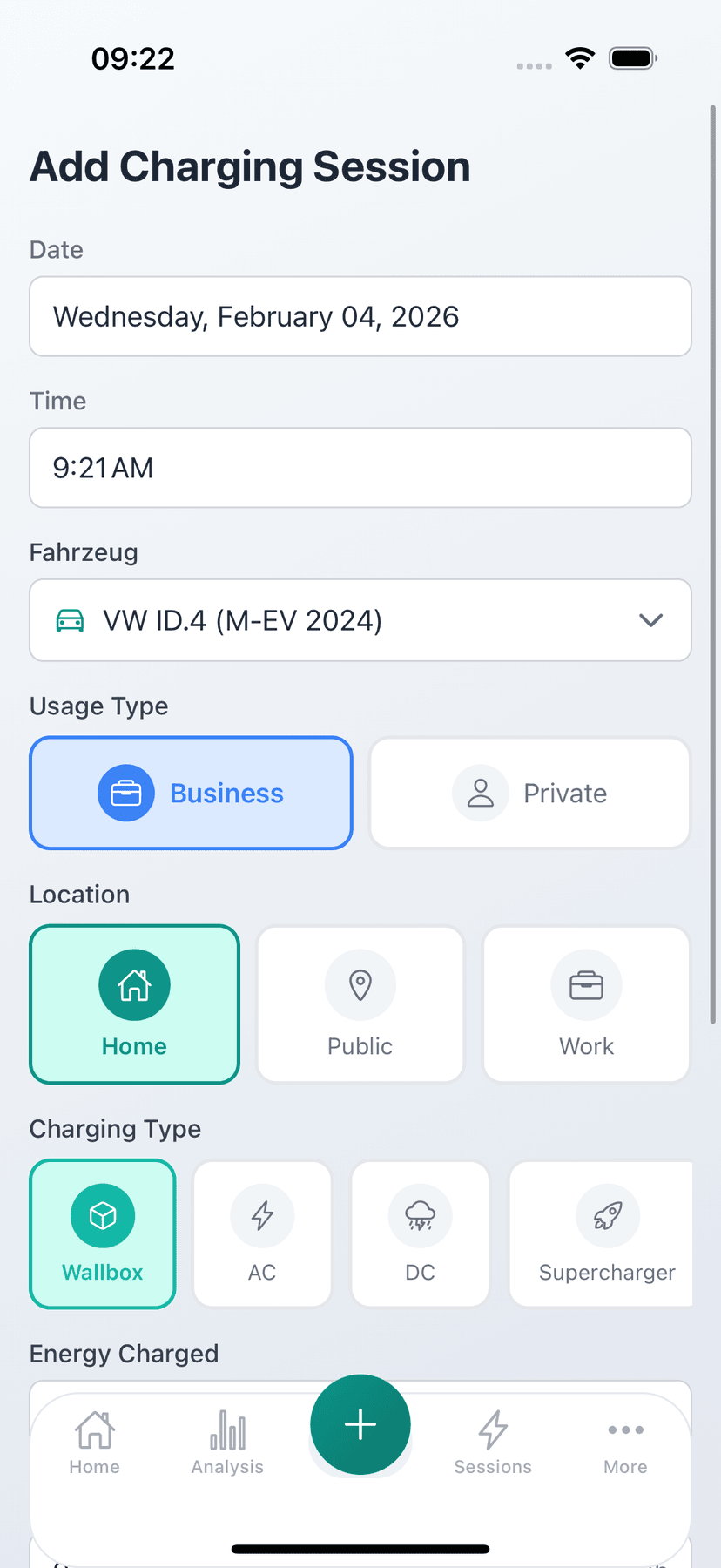

Record

Calculate your savings

With the 34 ct/kWh allowance for home charging, you can save real money. How much do you charge at home?

Yearly home charging

3,600 kWh

Deductible per year

1,224 €

Calculation: 3,600 kWh × €0.34/kWh = €1,224 deductible costs

for tax filing

instead of hours

Offline capable

Your data stays with you

Happy users

Freelancers and entrepreneurs

It's that easy

From charging to tax receipt in three steps

Add vehicle

Enter your license plate and optionally connect your wallbox for automatic tracking.

Record charging sessions

Record each charging session manually or let the wallbox integration do the work.

Create export

Export as PDF for your records or as DATEV CSV for your tax advisor.

LadeKosten vs. Alternatives

Compare for yourself: Why a specialized app is the best way

| Feature | LadeKosten | Excel / Spreadsheet | Tax Advisor |

|---|---|---|---|

| Time spent per month | 5 minutes | 2+ hours | 0 min (but costs) |

| Cost per year | €9.95 | €0 | €300+ |

| GoBD-compliant | |||

| DATEV Export | |||

| Wallbox integration | |||

| Allowance optimization | Extra charge | ||

| 100% Offline |

Time spent per month

Cost per year

GoBD-compliant

DATEV Export

Wallbox integration

Allowance optimization

100% Offline

* Prices and time estimates based on average values from our users

Save €1,200 per year – for just €9.95

The yearly subscription costs less than a cup of coffee per month and gives you an average of 120x the value back.

Yearly Plan

Only €0.83/month

- Unlimited vehicles

- Unlimited charging sessions

- Wallbox Auto-Sync (Beta)

- DATEV Export

- PDF Export

- GoBD-compliant reports

- Allowance optimizer

- Audit log

Standard

One-time purchase - use forever

- 1 vehicle

- Unlimited charging sessions

- PDF Export

- 100% Offline capable

All plans come with a 7-day free trial with full functionality. Subscriptions renew automatically but can be canceled at any time.

Frequently Asked Questions

Yes. All entries are stored in an audit-proof manner and cannot be changed or deleted afterwards. This complies with the principles of proper bookkeeping (GoBD) and is recognized by the German tax office.

Since 2024, you can deduct 34 ct/kWh for home charging as a flat rate without having to submit individual electricity bills. LadeKosten calculates this allowance automatically and documents all charging sessions in a GoBD-compliant manner.

Yes, all data stays on your device. There's no cloud requirement and no registration needed. Your sensitive financial data never leaves your smartphone.

We currently support go-e Charger (Home and Gemini) via local WiFi. The wallbox is automatically detected and charging sessions are recorded without manual effort. More manufacturers (Easee, Wallbox) coming soon.

With one click, you export all charging sessions as a DATEV-compliant CSV. Your tax advisor can import this file directly into DATEV - no manual transfer necessary.

The PDF export creates a clear summary of your charging sessions as a print-ready document. Ideal for your own records, reimbursement requests to your employer, or as proof for your tax return.

Yes, absolutely. All subscriptions can be canceled at any time through the App Store or Google Play. There are no hidden deadlines or cancellation fees. Your recorded data remains on your device even after cancellation.

Yes! You can try LadeKosten for 7 days free and without obligation. All premium features are available during the trial. You'll only be charged after the trial period - and only if you don't cancel beforehand.

After the trial period, your chosen subscription is automatically activated. You'll receive a reminder beforehand. If you don't want to continue, simply cancel within the 7 days - completely free and without giving a reason.

Start your tax-friendly charging documentation now

Download the app or receive free tax tips for EV drivers directly in your inbox.